Benefits for Buyers

Improve liquidity for businesses, increase working capital

Greater payment options for merchants who don't offer credit terms

Financing business expenses for both goods and services

24 hour convenience of online operation management

Cut back on administrative and payment costs

1. Use credit cards to increase business liquidity

PaySoon is an online payment service that assists companies with corporate credit cards in generating liquidity. PaySoon platform makes it easier for buyers to buy goods from merchants who do not take credit cards. Even when purchasers lack funds, this improves their liquidity.

2. Increase the payment deadline

Because it is crucial for the buyer to increase the deadline for paying for various expenses of the company. With PaySoon's service, the payment time can be extended up to 45 days without incurring interest. No securities are needed; considered as a source of fund that is more adaptable than other sources. This makes it easier for buyers to plan and budget their spending.

3. Cover company costs for both goods and services.

Buyers will be able to pay their invoices through the PaySoon, including the cost of raw materials, and the cost of services. When the buyer and seller agree to accept payment via Payson, such as for transportation expenses, rental fees, and various processing fees, the transaction will be verified in the system. Upon approval, the issuing bank will send funds via PaySoon's system directly into the bank account of the seller (Supplier).

4. Convenience of an online system that is 24*7 accessible

Buyers can access the billing system through PaySoon's system and conduct financial transactions using 24*7 online channels convenience of working without limitations on locations or times, in response to a new way of working in the digital age.

5. Increase productivity more easily while reducing costs

PaySoon is convenient and integrated operations into one dashboard. Real time reports are available. Simple to use, no need for IT system development. Lower operating costs for billing, cheque collection, and regular payments comparing to traditional process. Companies can switch to 100% online operations to cut costs, transparency and effectiveness.

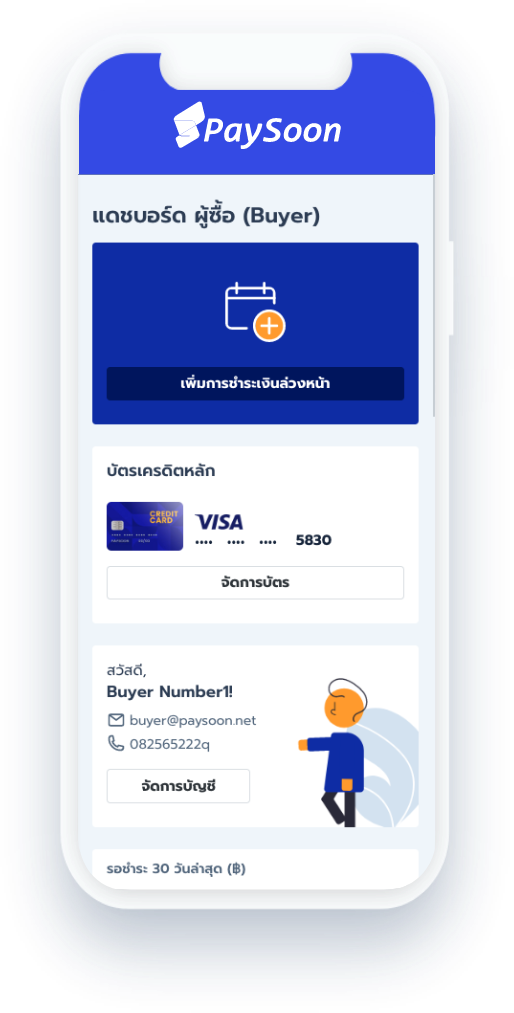

Buyer’s Journey

Buyer initiate payment

1. Create payment schedule

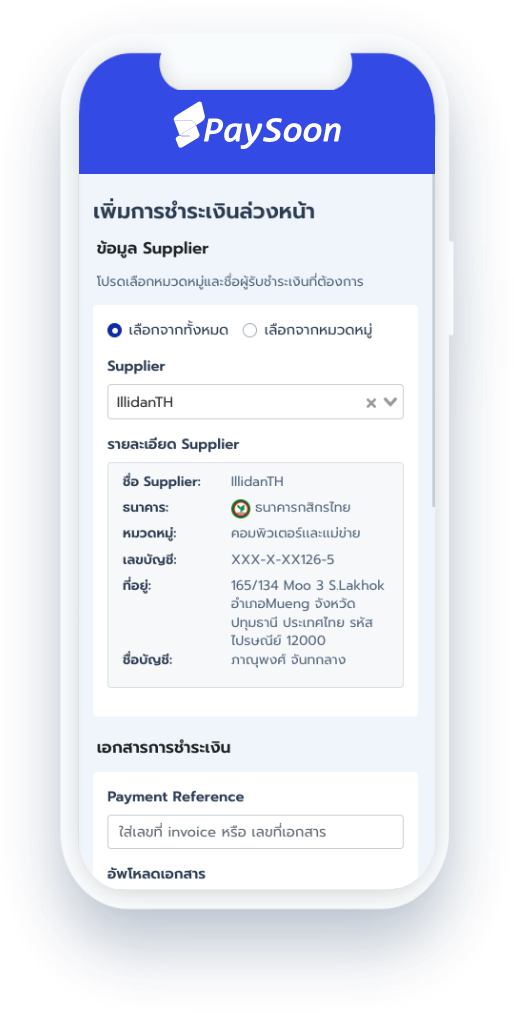

2. Enter payment detail

3. Fill in amount and card detail

4. Confirm payment schedule

Application Process

Enter detail

Log on to www.paysoon.net and enter detail

Submit document

Submit document via online (within 7 working days)

Verification

PaySoon verification and approval process

Onboarding

Onboarding and Go Live

Buyer’s Document

- Copy of ID Card

- Copy of House Registration

- Copy of Company Registration with minimum 6 months validity

- ** Upload digital files through PaySoon system

- ** All copies are to be certified and signed by authorized directors

Security that every business can be assured of

PaySoon is a system provided by Pay Solution Company Limited, which is licensed and regulated by the Bank of Thailand. All data is managed in accordance with PCI-DSS security standards in order to It will allow every business to use the payment system safely in every transaction